BTC Price Prediction: Analyzing Technical Signals and Market Drivers for September 2025

#BTC

- Technical indicators show mixed signals with price below moving average but positive MACD momentum

- Market sentiment reflects conflicting fundamentals between regulatory concerns and institutional adoption

- Key support at $105,994 represents crucial level for determining near-term direction

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support Level

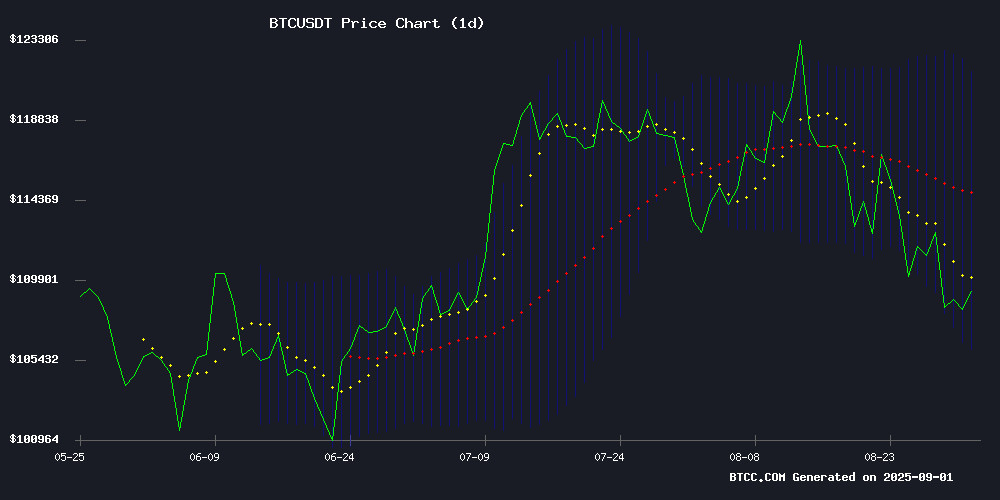

According to BTCC financial analyst James, Bitcoin's current price of $109,067 sits below its 20-day moving average of $113,784, indicating potential short-term weakness. The MACD reading of 1,346.9 suggests bullish momentum remains intact, though the price hovering NEAR the lower Bollinger Band at $105,994 could signal an oversold condition. 'The technical picture shows BTC testing crucial support levels,' James notes. 'A hold above $106,000 could set the stage for a rebound toward the middle band resistance.'

Market Sentiment: Mixed Fundamentals Amid Technical Consolidation

BTCC financial analyst James observes conflicting sentiment signals from recent headlines. While negative developments include potential pattern breakdowns and regulatory concerns from South Korean officials, positive catalysts emerge from Michael Saylor's bullish $1 million prediction and institutional adoption prospects. 'September traditionally brings volatility,' James comments. 'The market shows fatigue with the MVRV dead cross, but fundamental drivers like S&P 500 inclusion narratives provide underlying strength.'

Factors Influencing BTC's Price

Bitcoin Risks Drop Below $100K as Head and Shoulders Pattern Nears Invalidation

Bitcoin faces a pivotal technical moment as its price hovers NEAR the $101,500 support level. A breach below this threshold could negate the bullish Head and Shoulders continuation pattern, potentially triggering a decline beneath the psychological $100,000 mark.

Analyst Aksel Kibar warns that failure to hold this level risks invalidating the 6-month chart formation. The right shoulder of the pattern now serves as critical defense against further downside.

South Korea FSC Chief Nominee Faces Backlash Over Crypto 'Worthless' Remarks

Lee Eok-won, nominee for chairman of South Korea's Financial Services Commission, has drawn sharp criticism from the cryptocurrency community after declaring digital assets lack intrinsic value. His written statements ahead of confirmation hearings position virtual assets as fundamentally different from traditional financial instruments like equities or deposits.

The nominee's arguments echo the South Korean government's longstanding skepticism toward crypto. Lee contends volatility prevents cryptocurrencies from functioning as reliable stores of value or mediums of exchange—core characteristics of legitimate currencies. His remarks extend to institutional adoption, questioning the suitability of pension funds allocating to such speculative assets.

Market participants swiftly rebuked the comments through social media channels. The controversy emerges as regulators globally grapple with cryptocurrency classification frameworks, with South Korea's approach appearing increasingly restrictive compared to jurisdictions embracing digital asset innovation.

Bitcoin Price Prediction and New Crypto Presale Pepeto Draw Parallels to BTC's Historic Run

Bitcoin's trajectory from obscurity to a six-figure asset has become the defining narrative of cryptocurrency. The digital currency, which traded at fractions of a cent in 2009, now anchors market cycles with its predictable halving-driven scarcity model. Analysts see this pattern repeating, with near-term BTC targets between $118,000 and $140,000 before potential moves toward $200,000 by late 2025.

Market attention is shifting to Pepeto, a new presale project that claims to replicate Bitcoin's growth blueprint in compressed time. The comparison stems from Pepeto's positioning as a fixed-supply asset launching during a period of accelerating institutional crypto adoption. Reuters data shows Bitcoin recently tested record highs near $124,481 before consolidating above $110,000, demonstrating the staying power of its core valuation thesis.

Bitcoin MVRV Flashes Dead Cross as Market Shows Signs of Fatigue

Bitcoin's momentum appears to be waning after a brief dip near $107,000, just weeks after reaching an all-time high. The Market Value to Realized Value (MVRV) indicator, a key metric for assessing whether the cryptocurrency is over- or undervalued, has formed a dead cross between its 30-day and 365-day moving averages. This pattern, last seen in late 2021, signals cooling enthusiasm among investors.

Despite a 13.3% rally earlier this month, the divergence between price action and MVRV suggests the surge may be driven more by sentiment and institutional ETF adoption than fresh capital inflows. While ETF participation has added structural support to Bitcoin's market, historically such valuation stretches without proportional backing have led to consolidation or corrections.

3 Big Reasons September Could Spark a Bitcoin (BTC) Rally

Bitcoin's recent dip below $110,000 belies growing Optimism for a September resurgence. The cryptocurrency, which peaked at $124,000 in mid-August, now faces a critical month historically known for weak performance—yet market dynamics suggest otherwise.

The Federal Reserve's impending interest rate decision looms large. Chairman Jerome Powell's recent Jackson Hole remarks hinted at potential cuts before year-end, with an 83% market-implied probability of a 25-basis-point reduction in September. Such a move WOULD mark the first easing since December 2024, potentially reigniting risk appetite across capital markets.

Lower borrowing costs traditionally benefit speculative assets like BTC. The current 4.25%-4.5% rate range has constrained liquidity; its relaxation could funnel fresh capital into crypto markets. All eyes now turn to the Fed's September meeting—a pivot point that may define Q4's market trajectory.

Michael Saylor's Strategy Qualifies for S&P 500 Inclusion Amid Bitcoin Boom

Michael Saylor's Strategy has met all eligibility criteria for potential inclusion in the S&P 500 following a record-breaking Q2 performance. The firm reported $10 billion in net income and significant growth in its BTC holdings, underscoring Bitcoin's deepening integration with traditional finance.

Strategy cleared the S&P 500's stringent requirements with a market cap exceeding $8.2 billion, daily trading volumes over 250,000 shares, and consistent profitability. The company's $14 billion operating income and 70% subscription service growth reflect its transformation under new fair-value accounting standards implemented in January 2025.

The September 2025 rebalancing presents the next inclusion opportunity, with announcements expected September 5 and changes effective September 19. While the S&P Dow Jones Indices committee retains final authority, Strategy's qualification marks a watershed moment for cryptocurrency acceptance in mainstream markets.

High-Risk Bitcoin Gamble: $1M BTC Short With 20x Leverage Turns Sour

A trader's audacious $1 million Bitcoin short bet on Hyperliquid has backfired spectacularly. Using 20x leverage, the position now shows an unrealized loss of $180,000 as BTC's price climbs against the bearish wager.

The short position of 111.75 BTC contracts entered at $107,363 now faces liquidation at $114,830. Market movements have pushed BTC to $108,976, eroding the trader's initial $1 million USDC collateral to $814,874.

HyperLiquid's decentralized platform enabled this high-stakes gamble, showcasing both the potential rewards and existential risks of Leveraged crypto trading. The 20x multiplier amplifies both gains and losses, turning minor price fluctuations into existential threats for overleveraged positions.

Bitcoin Dominance Decline Misleads on Altcoin Season Prospects

Bitcoin's market dominance (BTC.D) dropped sharply from 65% to 58% over the past month, typically a signal for altcoin season. Yet the altcoin market cap—excluding BTC and stablecoins—fell $100 billion to $1.31 trillion, revealing a more nuanced reality.

While BTC’s price declined 11% in August, altcoins dropped 8%, creating the illusion of relative strength. Analysts like Crypto King warn dominance could stabilize or rebound in September, further dampening altcoin momentum.

The divergence highlights how raw dominance metrics can obscure underlying market weakness. Traders anticipating rotational plays may find fewer opportunities than the data initially suggests.

Bitcoin Cycle Extremes Index Hits 8.8%: Compression Phase Signals Expansion Ahead

Bitcoin trades at a critical juncture after breaching the $110,000 support level, a key defensive line for bulls. The breakdown reflects waning momentum as buyers fail to regain control amid persistent volatility. Despite surpassing its all-time high, BTC shows no meaningful recovery, fueling speculation of a deeper correction. Mounting selling pressure has investors questioning whether stabilization is possible before further downside tests.

Onchain data from CryptoQuant reveals a contrasting narrative. The bitcoin network is currently in a compression phase—a historical precursor to expansion periods marked by heightened volatility and large directional moves. This pattern suggests short-term weakness may be setting the stage for the next major market structure shift.

The coming days prove pivotal. Bulls must reclaim key levels to prevent capitulation, while bears eye potential further downside. The compression phase indicates an imminent high-stakes breakout, with Bitcoin's position generating intense market anticipation.

Michael Saylor Predicts Bitcoin’s Ascent to $1 Million, Declares End of Bear Market

MicroStrategy co-founder Michael Saylor has made a bold proclamation: Bitcoin’s bear market is over, and the cryptocurrency is poised to reach $1 million. In a recent Bloomberg interview, Saylor dismissed concerns about the current downturn, framing it as a precursor to a historic rally.

"The bear market isn’t returning," Saylor asserted, positioning Bitcoin as the linchpin of modern finance. His confidence stems from accelerating institutional adoption, shrinking supply, and surging global demand. "Bitcoin is either going to zero or to a million," he added, underscoring the binary nature of his conviction.

This outlook comes as BTC tests support near $108,000, a level some traders interpret as bearish. Saylor’s commentary reframes the volatility as foundational—a necessary consolidation before the next parabolic advance.

Crypto Hacks Surge in August with $163 Million Lost in 16 Exploits

August 2025 marked a grim milestone for the crypto sector as hackers siphoned off $163 million across sixteen major exploits, a 15% increase from July's $142 million losses. Blockchain security firm PeckShieldAlert highlighted that five incidents alone accounted for over half the total damages, underscoring the escalating sophistication of cyberattacks.

The most devastating breach involved a Bitcoin holder losing $91.4 million, while Turkish exchange BtcTurk suffered its second major hack in fourteen months—a $54 million theft following a similar June 2024 incident. These attacks expose critical vulnerabilities even among seasoned market participants.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a calculated opportunity for risk-tolerant investors. The current price consolidation near key support levels, combined with strong institutional narratives, suggests potential upside. However, investors should be aware of near-term volatility risks.

| Indicator | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | -4.1% below | Bearish short-term |

| MACD | 1,346.9 positive | Bullish momentum |

| Bollinger Position | Near lower band | Oversold potential |

| Support Level | $105,994 | Critical hold |